2024 could well have been a dud year for dealmaking, however despite almost every major economy going through a general election, escalating geopolitical tensions and the ever-prevalent economic challenges of cost inflation, supply chain disruption and labour shortages, M&A activity in the UK held steady to 2023 levels.

Take a look below the top level stats, and there are even more reasons to be optimistic about dealmaking in 2025. Interest rate cuts are anticipated bringing lower financing costs and improved investor confidence. Private Equity (PE) continues to face pressures to both deploy capital and deliver returns and buyers are becoming more adept at bridging the valuation gap, both through enhanced due diligence and deal structuring.

With market conditions stabilising and pent-up capital ready to be deployed, we’re cautiously optimistic for a more favourable M&A environment in the coming year.

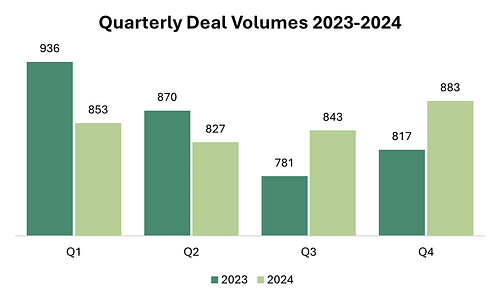

Steady deal volumes amid a quiet start

- 2024 deal volumes remained consistent with 2023 (3,404 deals vs. 3,406) however the market showed a decent amount of quarterly volatility.

- Uncertainty around the UK General Election contributed to a soft start to the year (1,608 deals completed vs. 1,806 in 2023), more than made up for by a pre-budget scramble which saw October deal completions of 462, 61% above the prior year.

- While the budget certainly didn’t feel like “Christmas come early”, it had that effect on deal volumes – the traditional pre-Christmas rush was nowhere to be seen and December volumes were 44% down on the prior year.

- Deal volumes seem to be building momentum and pointing towards increased levels of activity in 2025 – H2 2024 recorded 1,726 deal completions, 8% above 2023.

Notable mega-deals indicating increasing investor confidence

- 2024 was a banner year for high-value transactions, with several notable mega-deals pushing total deal values to one of the highest levels ever seen in the UK.

- Notable transactions included International Paper Co’s £7.8 billion acquisition of DS Smith PLC, and Swisscom AG’s £6.8 billion buyout of Vodafone Italy.

- Never ones to be left out, PE were also making waves, with the £5.4 billion institutional buyout (IBO) of Hargreaves Lansdown by Cinven and Nordic Capital, as well as Thoma Bravo’s £4.3 billion buyout of Darktrace featuring in the biggest deals of the year.

- The increasing market appetite and availability of funding for these bumper deals underscores the growing confidence among strategics and investors alike.

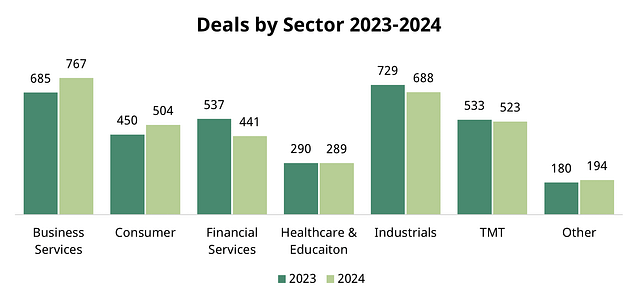

Private Equity platform acquisitions back in focus in key sectors

- Private equity acquisition activity surged with 250 platform deals completed in 2024, a 33% increase on the previous year, as firms face pressure from LPs to deploy capital.

- Key sectors seeing PE interest in 2024 included the traditionally attractive Healthcare and TMT sectors (particularly pharma and medical devices and software subsectors respectively) and a resurgence in Consumer activity, particularly in the travel & tourism, and experiential leisure sectors.

- 2024 remained a muted year for PE exits with pressure and expectation building for 2025 firms look to both deliver returns to LPs and demonstrate the track record of profitability which is essential for successful fundraising efforts in a competitive environment.

Buy-and-Build remains a priority

- Buy-and-build strategies took centre stage in 2024 with many investors choosing to double down on proven management teams and established strategies, driving significant roll-up activity across various sectors.

- Sponsor backed Professional Services firms led the charge with 306 completed deals in the year, an 11% increase from 2023. Firms like Palatine-backed BK Plus (seven acquisitions), Exponent-backed Xeinadin Group, and Inflexion-backed TC Group (six acquisitions each) were amongst the most active acquirers in the period.

- The Insurance space also saw significant deal activity, with 8 firms making 5 acquisitions or more in the year including Seventeen Group, Clear Group and Jensten.

Enhanced DD demands are stretching deal timetables

- More stringent buyer led due diligence processes are stretching out processes as buyers face increasing pressure to get things right in a more volatile market.

- Often these increased levels of DD are a result of buyers trying to get comfortable as they look to bridge the value gap between seller expectations and market realities (not uncommon in times of economic uncertainty).

- As well as delivering increased comfort on a businesses prospects, an extended due diligence period gives a buyer more visibility on current performance and gives a business the opportunity to grow into its valuation.

Key M&A Predictions for 2025

Agile dealmaking and bespoke processes essential for success

- A tougher deal making environment means cookie cutter processes aren’t delivering optimum results anymore and take up management bandwidth that could be better used elsewhere.

- We’re seeing bespoke rifle shot processes, and even bilateral deals becoming much more attractive to shareholders – engaging early with a limited number of key bidders who see the real strategic value in an asset and will operate discreetly and pay up.

- Following on from this, we continue to see increased outbound origination efforts from PE who are keen to not miss out on these opportunities – often targeting a shortlist of specific, highly attractive sub-sectors.

Snowballing growth of AI and the rush to capitalise

- The development and prevalence of AI is moving at incredible pace – and most businesses are unsure of the optimum way to utilise AI to best benefit their customers and operations.

- We expect to see a raft of acquisition activity from Corporates and PE as they race to maximise the opportunity and not get left behind.

- As well as the obvious boom in AI-driven software assets, we’re expecting to see activity in several AI adjacent industries at all levels from data centres and power supplies through to dedicated consultancies advising on how best to harness the power of AI.

March towards Net Zero

- As the UK continues to implement regulations aimed at achieving net zero targets, companies are using M&A to bolster their compliance efforts and enhance sustainability profits.

- Companies across various sectors are increasingly focused on ESG criteria, driven by a combination of regulatory pressures, changing consumer expectations and the recognition that sustainable practices can lead to long term financial performance.

- Businesses that prioritise sustainability in their products and operations will attract more interest from the market – particularly as PE LPs implement strict guidelines around ESG and Impact.

BPR changes driving change in family businesses

- Changes to Business Property Relief (BPR) have understandably caused significant concern among family business owners who are now facing up to an impending inheritance tax burden.

- Many business owners are now questioning their own succession plans, particularly in more traditional industries where there often isn’t the desire from younger generations to carry on the family trade.

- We’re seeing increasing enquiries from family businesses who are considering their options and with several leaning towards converting the family business into cash.

Source: S&P Capital IQ